Repaying Your Loans

Convenient, flexible options make it easy to pay back your student loan.

Trouble Paying

If you can't afford your student loan payments, don't wait until you fall behind to seek assistance. We offer options that can help.

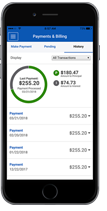

Your Account

We make it simple for you to understand and manage your account, so you'll have more time to focus on the other priorities in your life.

Good to Know

- Paying more each month? Target these payments however you want!

- Explore repayment plan options that could lower your monthly payments!

- Learn why you shouldn't pay for assistance with your loans.

Loan Default

Get all the information you need to get your account out of default and back on track!

Loan Payoff

Find out how to make that final payment and put your student loans behind you.